Ineptitude of the “Comprador Presidency”

Tshepo Kgadima Criticises Proposed Trade Deal With the US

South Africa’s proposal to buy liquified natural gas (LNG) from the US for 10 years in exchange for a quota of duty-free exports for a small section of highly subsidized, foreign-owned multinationals shows the ineptitude of the “comprador presidency”, maintains energy expert Tshepo Kgadima.

Describing it as “an abracadabra approach to macroeconomic policy formulation”, Kgadima, former chairperson of the state-owned Petroleum Oil and Gas Corporation of South Africa (PetroSA), said that the proposal is “neither technically feasible nor financially viable”.

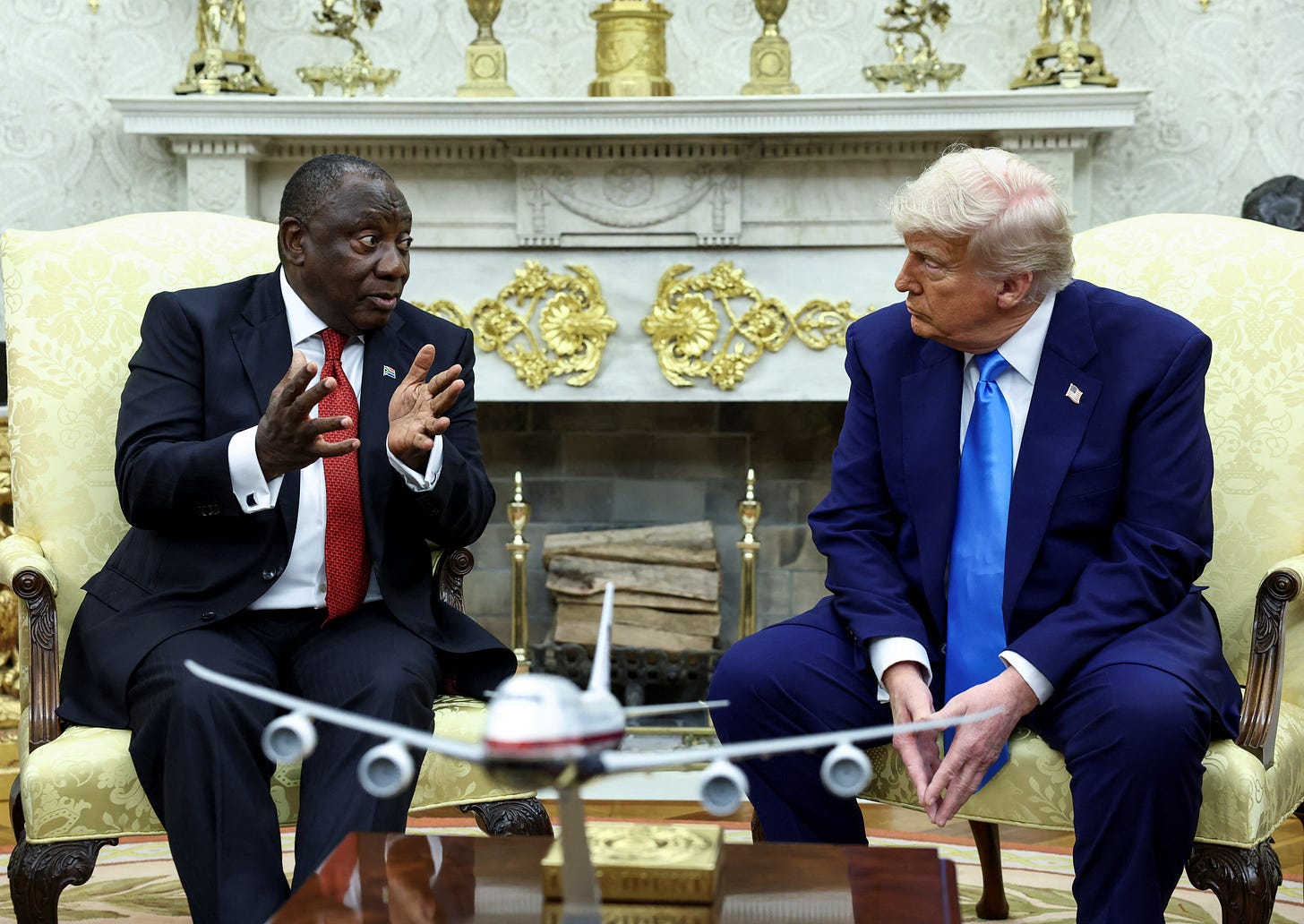

The proposal was made by the South African delegation led by its President Cyril Ramaphosa when he met US President Donald Trump on 21 May to reset the strained diplomatic relations and secure a trade deal exempting its exports from tariffs.

“It has a number of components. The first focus is … on trade and investment,” explained South Africa’s Trade and Industry Minister Parks Tau in a press conference in Washington DC following the meeting.

Buying gas for tariff exemption

“We indicated, given our impending shortage of gas, [an] appetite to procure LNG [liquified natural gas] from the US, which was … positively received, and it’s one of the areas that we will be following up on.”

Deeming the meeting “successful”, the office of President Ramaphosa said in a statement the following day, “Both leaders agreed to strengthen bilateral trade ties, increase investments for mutual benefit and forge collaboration in technological exchanges.”

Later, on 25 May, Minister in the Presidency and cabinet spokesperson Khumbudzo Ntshavheni revealed more details in an article.

As per the proposed deal, South Africa will be allowed to annually export 40,000 vehicles, 385 million kg of steel, and 132 million kg of aluminum to the US without facing tariffs.

African Growth and Opportunity Act (AGOA)

These and other exports from qualified sub-Saharan countries, including South Africa, faced zero tariffs while entering the US market under the African Growth and Opportunity Act (AGOA) passed by the US Congress.

Effective since 2001, it has been renewed several times ahead of expiry, providing US consumers tariff-free access to goods and raw materials produced by cheap African labor. However, the AGOA was practically nullified by the tariffs Trump imposed this April.

The 31% country-specific tariff imposed on South Africa, based on the trade deficit the US has with it, was reduced to the standard 10% during the 90-day pause announced days later. However, the 25% blanket tariff Trump imposed on all automobiles and a list of auto parts remains in place.

This is a particular problem for South Africa, 64% of whose exports to the US under the AGOA last year were automobiles. With 68% of its manufacturing outbound, South Africa’s auto industry is heavily export-oriented, with the US as its third-largest and fastest-growing market.

Securing a tariff exemption for this sector was a high priority for the South African government to minimize the losses from AGOA’s nullification and uncertain future.

Limited contribution of AGOA exports to the South African economy

However, Kgadima highlighted the limited value of these exports to the overall South African economy. “90% of AGOA exports are by 5% of heavily subsidized exporters who are all foreign-owned multinational companies” running automotive assembly plants in South Africa “with no manufacturing capacity,” he told Peoples Dispatch.

“The steel and aluminum smelters” are also foreign-owned and “heavily subsidized through below-cost-of-production” electricity rates charged by “the beleaguered state-owned electricity producer Eskom.”

In exchange for a tariff-free export quota for this small industrial sector, the South African government has proposed to import roughly 75 to 100 million cubic meters of LNG annually from the US for 10 years, costing between USD 900 million and USD 1.2 billion per year.

“The Ramaphosa Administration’s ineptitude on the geostrategic matters of energy security and industrialization of the South African economy is well demonstrated by their ill-conceived and deceitful plan to import LNG from the US,” criticized Kgadima.

“Neither technically feasible nor financially viable”

The plan, he said, is “neither technically feasible nor financially viable” with “no infrastructure capacity to handle any LNG imports, let alone processing facilities.”

The proposed trade deal also posits that the US will invest in developing South Africa’s gas infrastructure, including fracking.

“As former chairman of PetroSA, possessing vast knowledge and geological data of South Africa, I can competently state … that there are absolutely no viable resources of shale gas to frack and extract in South Africa. This has been a scientifically established fact since 1969,” he added.

If the administration had consulted “subject matter experts, we would have clearly advised” a focus on the prospects of deploying in the US the Gas-to-Liquids (GTL) technology for which a patent is still held by the South African National Petroleum Company (SANPC).

Formed in 2020 by the merger of PetroSA and two other Central Energy Fund (CEF) subsidiaries, the SANC is “the first company globally to commercially convert liquified natural gas into synthetic fuels and petrochemicals,” he said.

“Gas-producing countries such as the US would most certainly benefit from… the patented GTL technology of SANPC has a great potential to make South Africa a global champion in LNG,” which is “commercially and viably extractable for the next 90 years or so.”